Last week, I wrote about my experience of being a potential stem cell match for someone suffering from leukaemia or other blood disorder. Today, I’ll explain how someone is a “match” and the technology used to test this.

The theory

The surface of every cell (except red blood cells) is decorated with a cluster of proteins known as the major histocompatibility complex (MHC). In the event of infection, the invader (pathogen) is chopped up and parts are stuck onto the MHC. This serves as a signal to immune cells that a response is required. For example, if a cell is infected with a virus, parts of the virus are displayed. An immune cell known as a killer T cell will come along, recognise the MHC with added viral fragment, and pass a signal to the infected cell to shut down and die to slow the advance of the invading horde!

If cells from another human are encountered by the immune system, a difference in MHC tells the immune system that the cell is foreign and an immune response is mounted. This is an understandable response; it’s what defends us from infection but is exactly what we don’t want to happen in a transplant scenario. Stem cell transplants are even more complex as the cells go on to produce the immune system. These could go on to attack the recipient’s existing cells in what is known as graft vs host disease.

To avoid this rejection of cells from other people, we need to pick the donor correctly and it all comes back to the MHC. We need the MHC of donor and recipient to be as similar as possible to give the best chance for the cells to accepted, and in the case of stem cell transplant, avoid graft vs host disease.

The practicalities

How do you go about testing the compatibility of donor and recipient? We need to compare the proteins that make up the MHC in the patient and all the donors on our registry.

My former lecturer has a memorable saying about biochemistry: “DNA is easy, protein is fun“. What Dr Cox means by fun is that working with proteins is difficult, unpredictable and frustrating compared the the simplicity of dealing with DNA.

Fortunately, we understand that proteins are the products of genes, which are comprised of DNA. Here’s a reminder of the central dogma.

DNA –> mRNA –> Protein

By comparing the genes that code for the MHC, we can compare the nature of the proteins. The genes considered important for matching are: HLA-A (1,833), HLA-B (2,459), HLA-C (1,507), HLA-DRB1 (1,047), HLA-DRB3 (46), HLA-DRB4 (8), HLA-DRB5 (17), HLA-DQB1 (337) and HLA-DPB1 (205). They are named HLA after Human Leukocyte Antigen, another term for the MHC. The numbers in brackets indicate the number of protein variants known in January 2014 (source).

As you can see, there are lots of different versions of the proteins and the chances of any two unrelated people being a match is low.

The technology

(The following is based on information from Anthony Nolan. I don’t know what techniques other registries use but they are likely to be similar.)

One benefit of carrying out analysis on DNA is that we know how to amplify it. We can take the enzymes used to replicate DNA in bacteria and use them for our own purpose of replicating DNA in a plastic tube! This technique is called polymerase chain reaction and is one of the fundamental techniques of molecular biology. It is to DNA what a photocopier is to information on a sheet of paper. Kary Mullis won the Nobel Prize for inventing this process. Once DNA is amplified, we have lots of copies to do testing on.

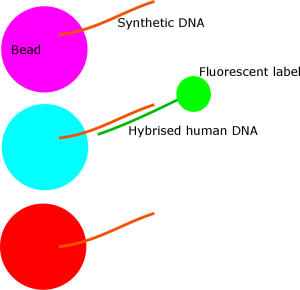

All samples from donors and patients are tested using a very clever fluorescence technique. Many, many different synthetic DNA molecules are attached to lots of tiny fluorescent beads. Each bead has a unique colour and is decorated with only one type of DNA. Elsewhere, the amplified DNA from the humans is labelled with a fluorescent molecule of a different colour. If the synthetic DNA and DNA from the human being tested are similar, they will stick together, known as hybridisation. Each bead is then looked at by a computer controlled microscope that identifies the colour of the bead, and if DNA has stuck. If you want more information about this remarkable machine, check out the product website. This method is used as a primary way to identify the type of MHC of the patient and potential donors, however it only gives a rough idea of similarity as DNA will still hybridise if there is a small difference.

This is the technique used to test all donors and patients. Next week, I’ll talk about how higher resolution matching is achieved.

If you’re hungry for more information or interested in joining a stem cell registry, I hope these links to UK organisations will satisfy you.

BBMR – Blood donors can join at next session if aged 18-49.

Anthony Nolan – People aged 16-30 can join.

DKMS – Accept people aged 17-55 (only 18+ called to donate).

If you’re in another country, take a look at this extensive list of stem cell registries from reddit.

This post is composed of my own views and opinions and not those of the above organisations.